Has your therapy practice experienced a slowdown in the past 6-12 months?

Are you doing the same thing as always but getting fewer consult calls and new clients? Is your once infallible waitlist quickly coming to an end? You are not alone!

Every day, I speak to therapists who share a sense of unease or fear about the future. These therapists are at every stage of their career: from recently licensed to established solo practitioners, group practice owners, and large clinic founders.

“Things are slow,” they tell me. “Numbers are down,” they say with a mix of confusion and concern. “The well is drying up,” echoes through our conversations, painting a picture of a profession grappling with unseen challenges.

As someone deeply entrenched in the world of mental health marketing and web design since 2006, I’ve seen the natural ebbs and flows of the industry. This is more than just a passing concern; it’s a reflection of a deeper, more systemic issue that seems to have taken root in the world of therapy.

The State of Therapy Today

The past year, especially the last six months, has been different. The downturn isn’t just a blip on the radar; it’s a storm that’s been gathering pace, threatening the stability and growth of therapists across the country.

I’m not saying all this to be a glib Debby Downer. Rather, I am spurred by a deep desire within me to peel back the layers of this issue. It’s not enough to simply nod in agreement or offer the same old platitudes on a consult call. I feel a deep, pressing need to understand why this is happening. Hence, this blog post.

Keep reading for a deep dive into the data, the trends, and the shifting landscapes of therapy supply and demand.

The goal is to understand why you are slower than ever before. This blog post is more than a professional curiosity … it’s a “State of the Therapy Union” … a labor of love born out of a genuine concern for the community I’ve spent nearly two decades serving.

Looking For Answers in SEO Keywords

As a therapist marketing professional, I was certain that the answer to “why are you slow” was hiding in the search engine keyword data. “Surely, there must be fewer people searching for therapy,” I theorized. “The COVID therapy bubble has burst and now we’re coming back down to earth,” I guessed. Turns out, I was wrong!

To get answers, I analyzed 20 popular keywords people use to search for therapy on Google. Using ahrefs (a paid SEO tool), I created a database of monthly search volume from September, 2015 – March, 2024 for each of the below 20 keywords, which cover a wide range of topics and ways people search for therapy.

- Anxiety Therapist Near Me

- Anxiety Therapist

- Anxiety Therapy

- Couples Counseling

- Couples Counselor

- Depression Therapist Near Me

- Depression Therapist

- Depression Therapy

- Online Therapist

- Online Therapy Near Me

- Online Therapy

- Psychologist Near Me

- Therapist Near Me

- Therapy For Anxiety

- Therapy For Depression

- Therapy For Trauma

- Therapy Near Me

- Trauma Therapist Near Me

- Trauma Therapist

- Trauma Therapy

My Approach to Analyzing the SEO Keyword Data

After creating my spreadsheets and using good ‘ole human intuition, I brought the data into ChatGPT for more detailed analysis. For days, this became my obsession. How many different ways could I get ChatGPT to look at the data? Surely, there must be something I’m missing.

By asking various questions and breaking down the data into digestible charts and graphs, I sought to pinpoint the discrepancies between the rising online interest in therapy services and the declining client engagement therapists are experiencing.

What I hoped for was a clear answer. Something in the data that cleary shows how searches are down across the board in the last 6-12 months. Maybe that’s why I spent so long looking …

Hundreds of chats, charts, and insights later, I came to one infallible conclusion: the answer was not hiding in the data. Though, the data did reinforce my understanding of what words and phrases people use to search for therapy. More on that later.

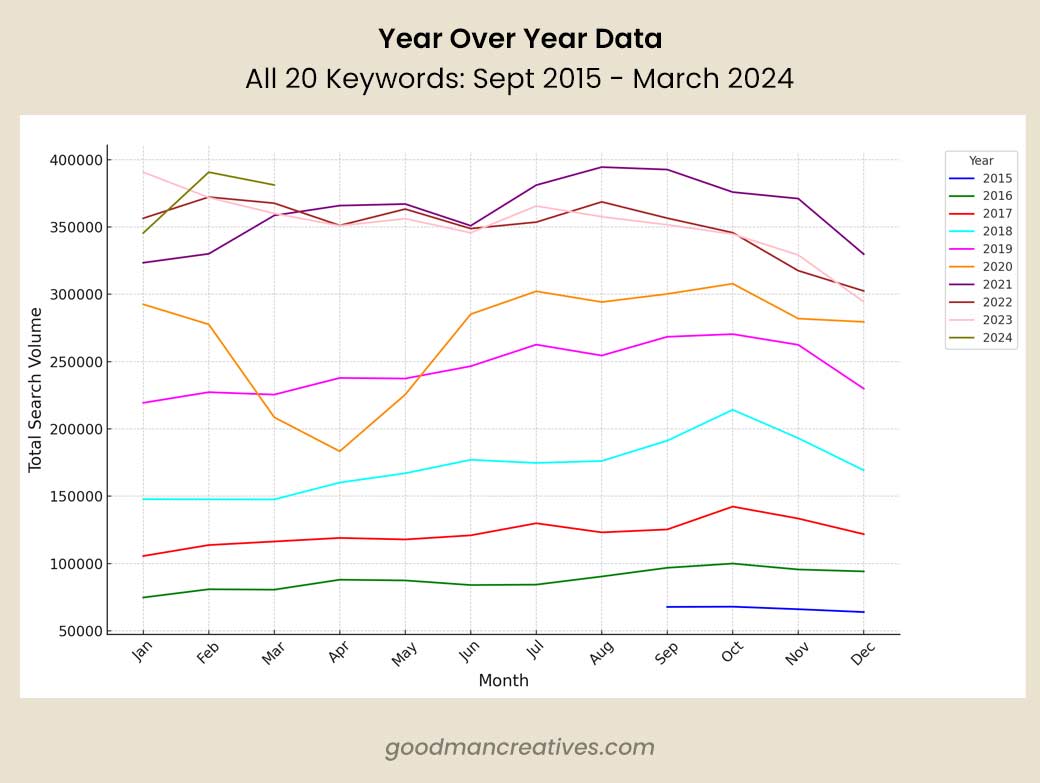

Google Searches For Therapy Remain Consistent

While there are some natural fluctuations and variances from keyword to keyword and month to month, the overall numbers show a statistically insignificant change in the past year.

The below chart shows combined data for all 20 keywords, comparing the past 12 months to the same 12-month period before it. That means comparing November 2023 to November 2022, March 2024 to March 2023, etc.

Contrary to expectations, my analysis revealed that the overall volume of web searches for therapy services has remained relatively stable.

There was a strange 11.57% drop in searches in January 2024 … a month that is usually the most busy of the year for therapists. However, other than this and a few other minor fluctuations, the overall trend does not indicate a significant decrease in search interest for therapy services.

| Month | This Year | Last Year | % Change |

|---|---|---|---|

| Apr | 351,104 | 350,907 | -0.06% |

| May | 363,286 | 356,148 | -1.96% |

| June | 348,780 | 345,669 | -0.89% |

| July | 353,577 | 365,563 | +3.39% |

| Aug | 368,628 | 357,600 | -2.99% |

| Sep | 356,536 | 351,635 | -1.37% |

| Oct | 345,744 | 344,643 | -0.32% |

| Nov | 317,518 | 329,199 | +3.68% |

| Dec | 302,473 | 294,348 | -2.69% |

| Jan | 390,691 | 345,475 | -11.57% |

| Feb | 371,859 | 390,680 | +5.06% |

| Mar | 360,032 | 381,160 | +5.87% |

Can We Blame Online Therapy Sites Like TalkSpace and BetterHelp?

The quick answer is “maybe.”

In the past few years, I have made no secret of my feelings towards these behemoth online therapy sites. Backed by buku bucks from Silicon Valley investors, they have no pressing need to show a profit — let alone pay their therapists what they are worth. (I’ll table that last point for another day).

These platforms operate under a different set of financial pressures, or the lack thereof, which allows them to engage in marketing and operational strategies far beyond what’s feasible for individual therapists or smaller practices. This means navigating a digital ecosystem where your therapist marketing budget dollars yield diminishing returns, making it increasingly challenging to compete for attention in a crowded online space.

Subscription-Based Models Make Therapy a Disposable Commodity

The rise of tech-based therapy platforms has reshaped public expectations around mental health services, contributing to the challenges faced by “traditional” therapists like you. The convenience and accessibility of these platforms, while beneficial in expanding a shareholder’s dividends, have fostered an environment where therapy is increasingly viewed through a lens of disposable consumerism. Don’t even get me started on the absurdly low rates these platforms pay their therapists.

Many therapy clients now expect:

- The ability to switch therapists without having to talk to the therapist about why

- Dirt-cheap therapy

- Regular communication via text/SMS

- A lack of accountability

- Instant results

Unfortunately, the ease of use and low price of these platforms may well entice your dream client away from your practice. Then, when they have a negative experience, there’s a solid chance they are not going to look for a new therapist because they now have more evidence that “therapy doesn’t work.”

In my own experience, I was wooed by the very things I’m talking about here. I signed up for a month of TalkSpace, had a terrible therapist, requested someone new, was equally unimpressed, and quit the platform. It’s only because of my deep commitment to my mental health that I chose to find a therapist the “old-fashioned way.”

Budget-Strapped GenZ and Millenials Love Cheap Online Therapy

Studies show that Millennials and Gen Z exhibit a strong openness towards mental health care — especially when that care comes with a digital solution. These generations, characterized by their comfort with technology, are driving demand towards platforms like BetterHelp and Talkspace.

Despite this trend, there’s a critical gap between the desire for therapy and actual engagement. While nearly 2 in 5 from these generations plan to seek therapy, only 1 in 5 currently are, with cost being a major barrier for 58% of them.

Membership Seems to Be Declining

The most confusing aspect of these online therapy platforms is that their user base is actually trending downwards. Talkspace reported a decrease from 15.4 million active users in 2022 to 11.7 million in 2023¹². Similarly, BetterHelp observed a 10% reduction in average monthly paid subscribers from the second to the fourth quarter of 2023³.

It’s worth noting that these numbers may reflect B2B customers as well as B2C customers. I’m not clear on whether the platforms count every employee of a company if they sign a partnership agreement or how exactly they count “lives on the platform,” as they coldly call it in their quarterly reports.

My take on these declining numbers is that people want a more traditional approach to therapy and don’t appreciate the revolving door nature of the Silicon Valley model. That said, when a giant company has declining revenue, it’s a safe bet they will throw more money at marketing and sales … which means even more competition and higher ad costs on Google.

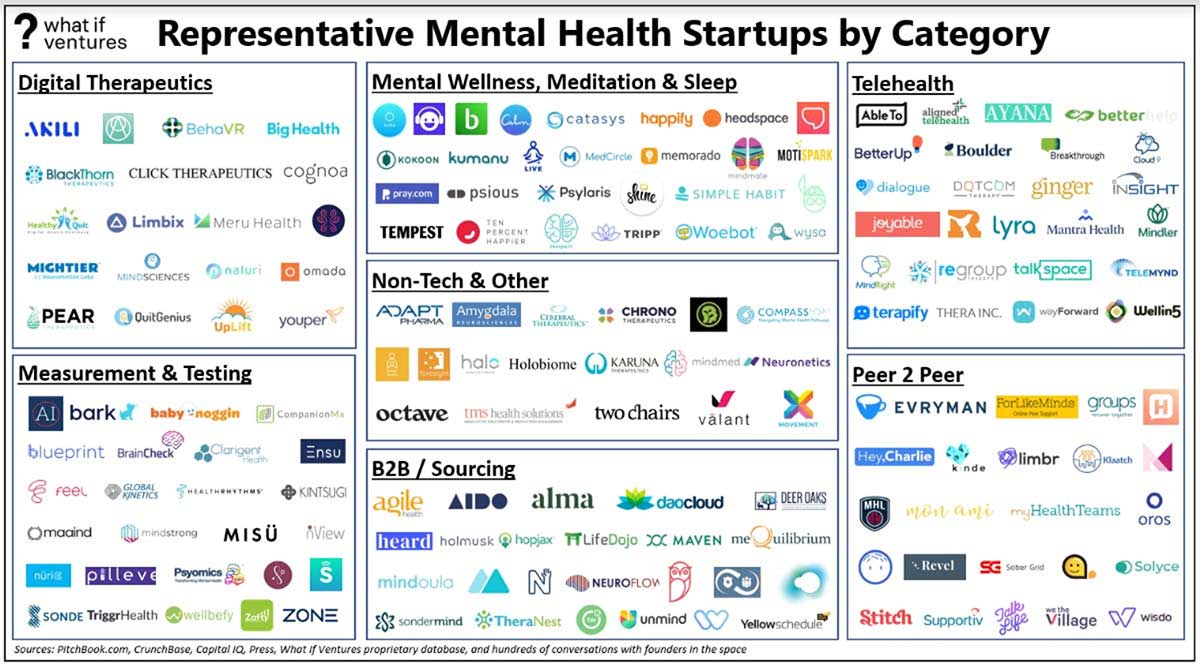

Competition is Fiercer Than Ever

It’s not just the online therapy platforms that are fighting for top placement in the Google SERP (search engine results page). According to What If Ventures, the number of mental health startups was approaching 1,000 in 2020. By now, I would guess that number has doubled! Why? One acronym: COVID-19.

COVID-19 Skyrocketed Competition Online

Before the pandemic, many therapists had a website they did not actively update or promote — relying instead on an, “if you build it, they will come” philosophy. Digital marketing efforts were generally more subdued, with a heavier reliance on traditional methods like in-person networking and directory listings, such as Psychology Today profiles.

In my conversations with therapists, I regularly heard concerns about how running ads might “cheapen” their practice in the eyes of potential clients. There was a prevailing sentiment that seeing the word AD next to a Google listing somehow detracted from the authenticity of the practice, casting a shadow of commercialism over a field deeply rooted in personal connection and trust. As a result, there was far less competition on Google – both with Google Ads and SEO.

Pre-COVID, it was not uncommon to see a $30 cost per lead with Google Ads. That means if you had a 50% success rate of converting consults to clients, you were paying $60/new client. Those days are long gone!

The arrival of COVID-19 marked a dramatic shift. Forced into online therapy, the therapy community quickly embraced digital platforms not only for service delivery but also for marketing. The necessity of standing out in a suddenly saturated online market led to a newfound focus on digital marketing strategies, including SEO and social media. This period also saw therapists’ operational costs decrease due to reduced physical office needs, freeing up budgets for online advertising.

Post-pandemic, this digital embrace has not waned. The reliance on digital strategies for client acquisition and engagement remains strong, representing a significant change from the pre-COVID era. Today, maintaining a dynamic online presence is not just common; it’s considered essential for growth and visibility in the therapy field. Which means, more competition for the same searches.

Google Ads Budgets Are Soaring

With Google Ads, the average cost per click has gone up exponentially in the past five years. That means you are now getting half as many leads and clients for the same marketing budget.

I remember being head of Marketing for a large mental health clinic in San Francisco when the online therapy platforms really began to take off. We found that even with our larger budget, we had a tough time competing with the additional Google Ads competition

SEO is Like David vs Goliath

If you google “therapist near me,” you’ll probably find that Psychology Today, Yelp, ZocDoc, GoodTherapy, and a handful of other mega-sites dominate the top 10 organic results. This is because they invest heavily in SEO (search engine optimization).

Unlike a solo practitioner’s modest SEO efforts, which might include publishing a few articles monthly and securing a backlink or two, these companies execute SEO on an industrial scale. Fortunately, it’s still possible for your local practice to show up on page 1. You just need a strategy and consistency.

Blame the Economy: Gas, Groceries, or Therapy

The recession presents another layer to the complex puzzle of the current downturn in therapy services. Rising costs across the board—be it gas, food, or energy—have tightened the financial belts of many, leaving less disposable income for what many consider non-essential expenditures. This financial strain is exacerbating concerns over financial security for the future, compelling individuals to prioritize their spending with increased caution.

The irony is palpable; at a time when mental health support could be more critical than ever, the willingness to invest in therapy diminishes.

This scenario starkly contrasts the unique circumstances presented during the COVID-19 pandemic. Then, with more people at home, facing fewer everyday expenses and armed with an abundance of time, the demand for therapy services saw a significant surge. I call it the “COVID therapy bubble.”

However, as we edge further away from the peak of the pandemic, it’s becoming clear that this bubble has burst. We’re witnessing a recalibration of priorities and financial commitments as the world slowly returns to its pre-pandemic rhythms. The economic downturn has instilled a heightened sense of financial vigilance, making the decision to allocate funds towards therapy a more scrutinized and, for some, a deferred choice.

Interesting Observations About Client Search Behavior

Sadly, my extensive SEO keyword data (9 years of search trends for 20 different keywords) did not show a clear, “this is why you are slow.” However, analyzing the data did shed light on some fascinating insights into human behavior as they search for therapy online.

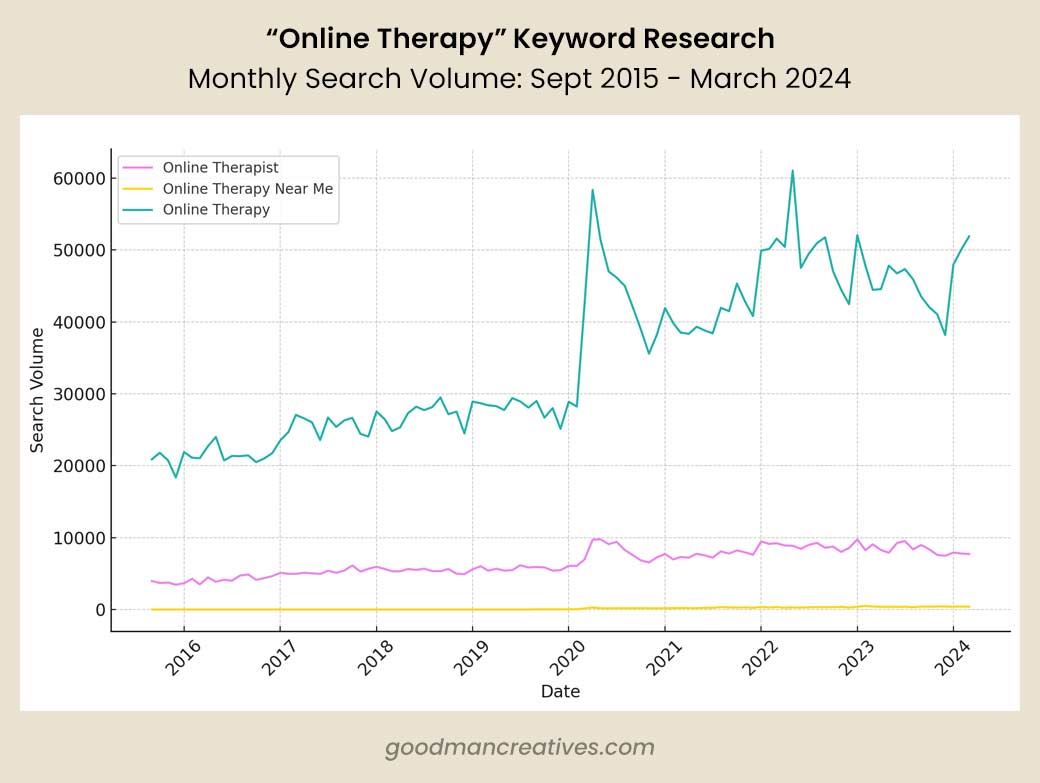

Online Therapy Searches

Total number of searches on Google (via ahrefs): Sept 2015 — March 2024,

- Online Therapy — 3,585,932

- Online Therapy Near Me — 14,580

- Online Therapist — 679,481

- Therapist Near Me (for comparison) — 9,748,405

Even before COVID-19, searches for online therapy were quickly increasing in popularity and often rivaling searches for in-person therapy. It should also come as no surprise that online therapy searches skyrocketed in 2020 and 2021, with nearly 1,000,000 searches for the exact keyword of “Online Therapy.”

What shocked me was that even in the height of the pandemic, searches for “Online Therapy” never came close to the traffic generated by searches for “Therapist Near Me,” which had more than 5,000,00 searches in 2020 and 2021. This data suggests that even when people are looking for online therapy, they still want to find a local therapist (and perhaps just assume that therapist will offer online?)

Other data points of interest:

- The keyword “Online Therapist Near Me” never really caught on, clocking in with a meager 8,500 searches during that same two-year pandemic period.

- “Therapist Near Me” plummeted in the first three months of the pandemic (March-May, 2020). However, it quickly regained search volume and has not slowed down since, with a few statistically insignificant months sprinkled in.

Profession vs Service (aka, Therapist vs Therapy)

When choosing the best SEO keywords for a therapist’s website and Google Ads, as well as optimizing keywords on Google My Business (GMB) profile, we need to consider the search intent of a user. That means understanding what people type in when they are actually ready to start therapy. You don’t want people coming if they are just doing research.

For example, if someone searches for “depression therapy,” are they looking for a therapist that specializes in depression or are they looking for information about what therapy for depression looks like?

To me, a search for “depression therapist” or “therapist that treats depression” shows far more intent than “depression therapy.” With so much data at my fingertips, I wanted to understand how that theory stood up. Here’s the big picture

“Therapist” searches are 342% more popular for general “Near Me” searches than “therapy” searches.

For issue-specific searches (depression anxiety, and trauma), the phrase “therapy” generally wins by a landslide.

It’s worth noting that while the overall data trends towards the keyword “therapy” having a higher number of search traffic, the data does not show how many of those people converted into clients … which is the most important metric.

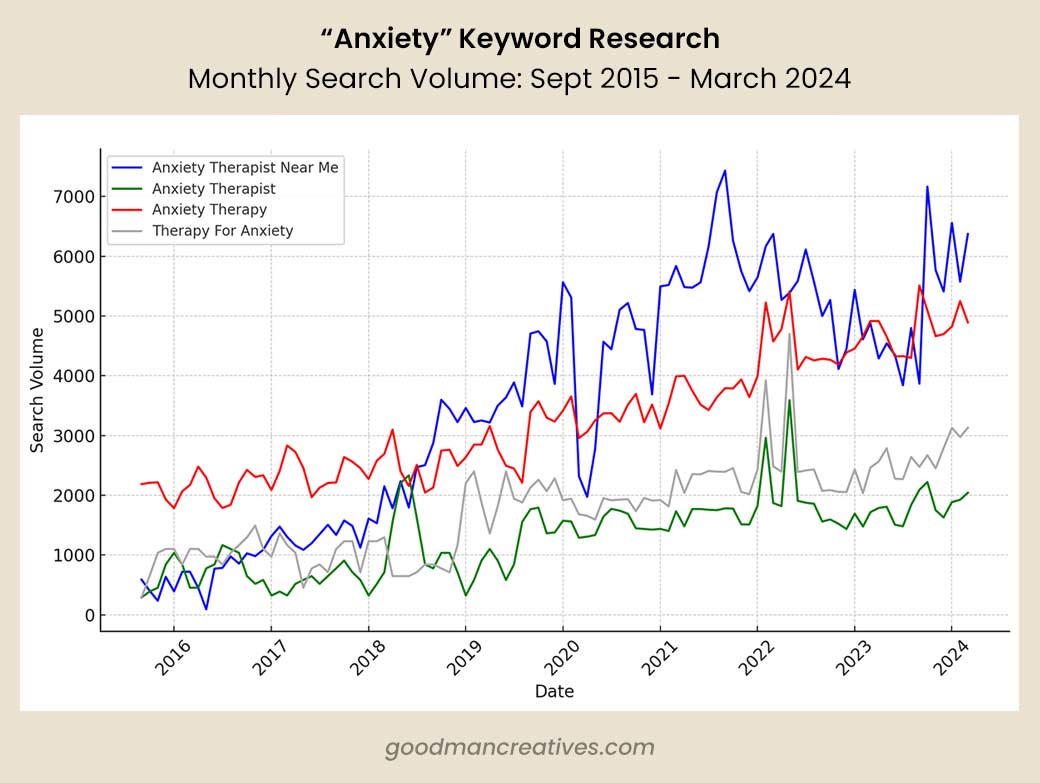

Anxiety Searches

The numbers below represent the total number of searches on Google (via ahrefs): Sept 2015 — March 2024,

- Anxiety Therapy — 337,348

- Anxiety Therapist — 133,795

- Therapy for Anxiety — 182,412

- Anxiety Therapist Near Me — 365,819

Winner: “Therapy” has 4% more searches than “Therapist” — (519,740 ~vs~ 499,614)

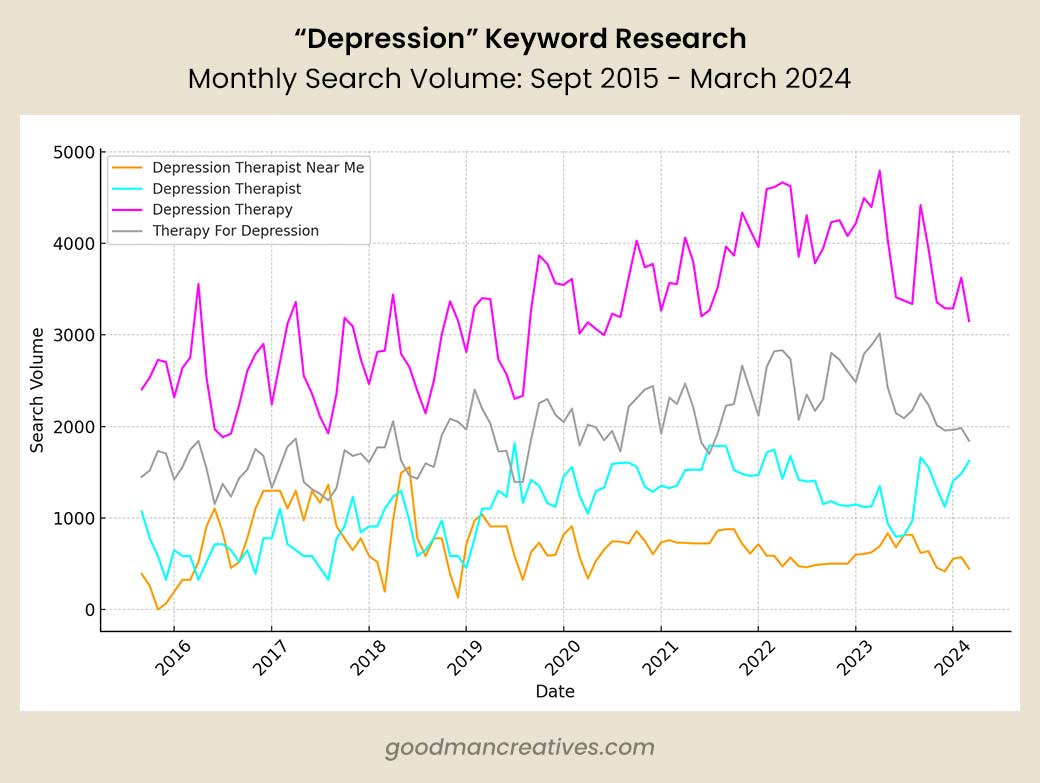

Depression Searches

The numbers below represent the total number of searches on Google (via ahrefs): Sept 2015 — March 2024,

- Depression Therapist Near Me — 72,642

- Depression Therapist — 113,987

- Depression Therapy — 336,705

- Therapy For Depression — 202,743

Winner: “Therapy” has 288% more searches than “Therapist” — (539,448 ~vs~ 186,692)

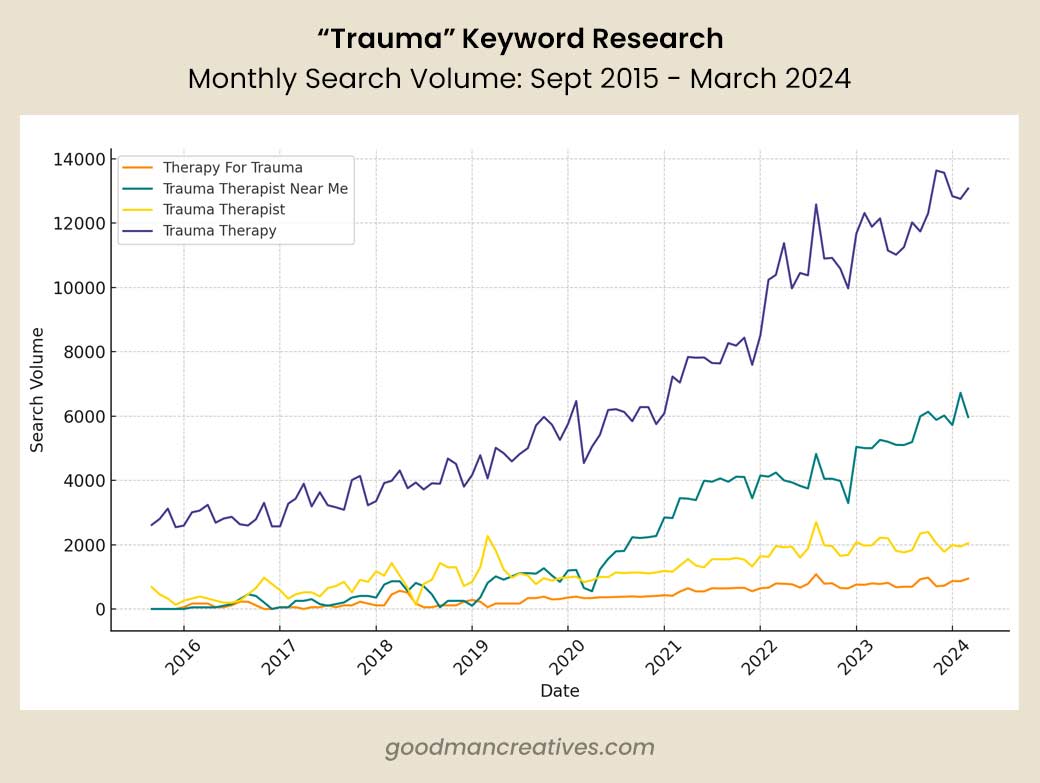

Trauma Searches

The numbers below represent the total number of searches on Google (via ahrefs): Sept 2015 — March 2024,

- Therapy For Trauma — 40,329

- Trauma Therapy — 664,802

- Trauma Therapist Near Me — 215,387

- Trauma Therapist — 122,259

Winner: “Therapy” has 208% more searches than “Therapist” — (705,131~vs~ 337,646)

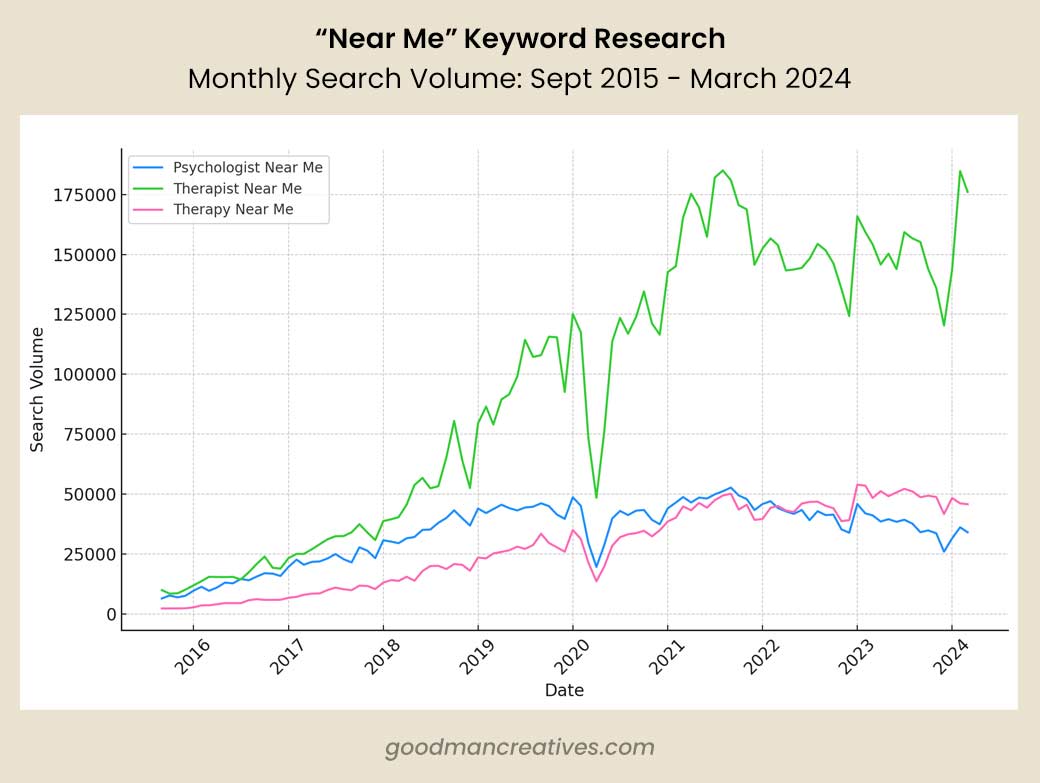

“Near Me” Searches

The numbers below represent the total number of searches on Google (via ahrefs): Sept 2015 — March 2024,

- Therapist Near Me — 9,748,405

- Therapy Near Me — 2,848,986

- Psychologist Near Me — 3,494,438

Winner: “Therapist Near Me” by a landslide. The term is 3,421% more popular than “Therapy Near Me” and 2,789% more popular than “Psychologist Near Me.” Also of interest is that people are more likely to search for a psychologist near them than general therapy. This is in direct opposition to how people search for help with their particular issues.

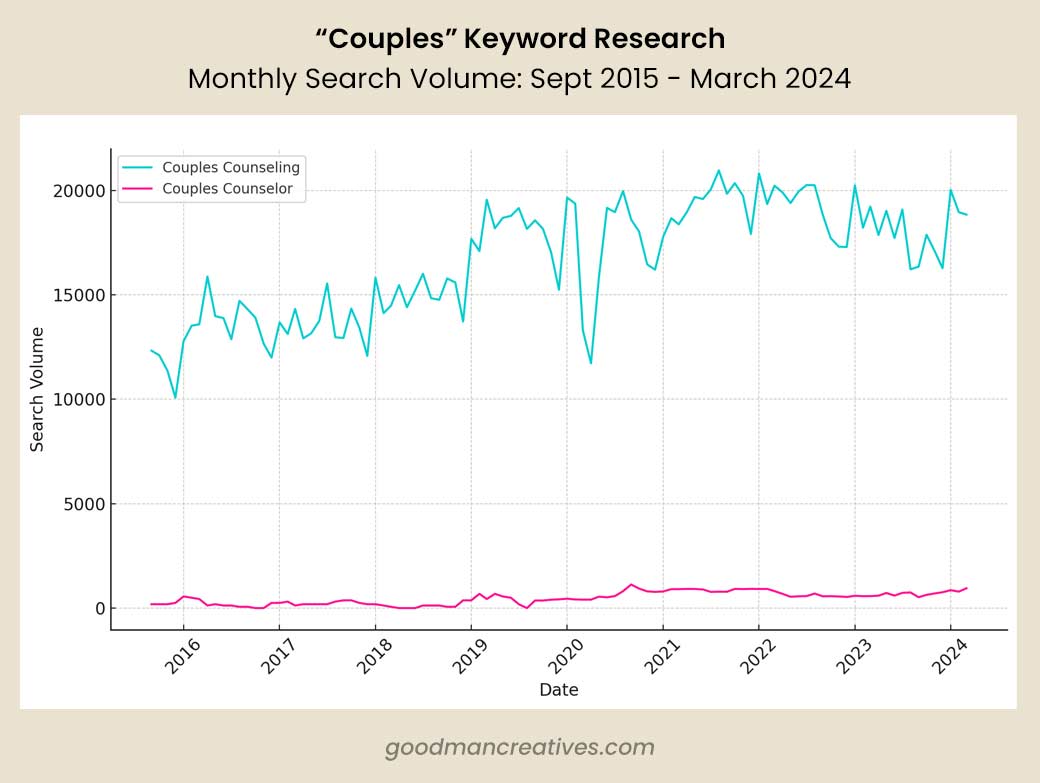

Couples Counseling vs Couples Counselor Searches

The numbers below represent the total number of searches on Google (via ahrefs): Sept 2015 — March 2024,

- Couples Counseling — 1,712,569

- Couples Counselor — 48,793

Winner: It’s not even close! People are 3,509% more likely to search for “Couples Counseling” than “Couples Counselor.”

Even if the percentage of searches that convert into clients is exponentially higher for a counselor (a theory, not a data-driven fact), the sheer number of extra searches for couples counseling tells us that it’s a keyword you need to focus on.

How to Reverse the Trend and Get More Clients

Maintaining a steady stream of therapy clients during a downturn requires a multifaceted approach that combines both traditional and digital marketing strategies. The key is not to rely solely on one method but to create a diversified marketing portfolio that can weather the natural ebbs and flows of client demand. Here’s how therapists can build a resilient practice:

Build a Solid Foundation

The cornerstone of any successful therapy practice is a solid foundation, characterized by clear professional values, a well-defined target clientele, and a strong service offering. Understanding who you are as a therapist and who you serve best is critical for directing your marketing efforts effectively. If you need help building your foundation, check out the $300k Therapy Practice Program.

Have an Effective Website

Your website should be more than just a digital business card; it needs to be an effective tool for attracting and converting potential clients. This means clear messaging, a user-friendly design, and content that speaks to the needs and concerns of your target audience. Ensure your website accurately reflects your practice’s values and specialties, making it easier for potential clients to see themselves working with you.

Focus on Digital Marketing

- Google Ads — This is the best way to get your practice in front of people who are actively seeking therapy. It’s the fastest way to get on page 1 of Google, but it’s not the cheapest. Expect to pay between $100-$300/client with Google Ads … and possibly more when you first get started.

- SEO (Search Engine Optimization) — The best long-term gift you can give your practice. Focusing on SEO and building backlinks is how you can eventually show up on page 1 of Google without paying for ads.

- Directory Sites — When you have a solid foundation and know how to speak to your dream client, your Psychology Today, GoodTherapy, ZocDoc, and other listing sites instantly become more effective. While you probably won’t fill your practice with these sites, wouldn’t it be nice to have an extra 1-3 clients per month?

- Referral Building — Don’t underestimate the power of good old-fashioned in-person networking. Everyone stopped doing this during COVID-19… it’s time to get back out there and establish strong relationships with other professionals, such as doctors, schools, and community leaders.

By diversifying your marketing efforts across these digital and traditional methods, you create multiple pathways for potential clients to discover and connect with your practice. This not only helps in maintaining a steady client base during downturns but also positions your practice for growth when the market rebounds.

Remember, the goal is to build a resilient practice that can adapt to changes in the market, ensuring you’re always positioned to meet the needs of those seeking therapy.

If you need help, fill out the form below and ask me anything. Or, schedule a free consult and let’s chat about how what it takes to get a steady, predictable stream of clients you love at all times.